Border Communities Capital Company, LLC

Border Communities Capital Company, LLC (BCCC) utilizes the New Markets Tax Credit (NMTC) program to offer financing to underserved communities located near the United States-Mexico border in the states of California and Arizona. Targeted counties include San Diego, Imperial, Riverside and Yuma, with a portion of BCCC’s NMTC allocation deployed on non-metropolitan communities.

BCCC makes equity investments, equity equivalent investments, and loans to finance land and infrastructure development, vertical building of office, retail, commercial, industrial, and service space. Products offered include development and construction short- and intermediate-term loans. BCCC can offer below market interest rates, longer than standard period of interest-only payments, more flexible borrower credit standards, loan loss reserves that are less than standard, non-traditional forms of collateral and other below market or non-conventional features. With its NMTC allocation, BCCC will continue to provide capital and financing to projects that spur development, upgrade communities, and create services and opportunities for low-income communities.

2009 Allocations of New Markets Tax Credits

Border Communities Capital Company, LLC (BCCC) was formed as a Community Development Entity (CDE) in 2002 and won a $50 million NMTC allocation in the first funding round. BCCC won an additional $50 million of NMTC in the 2009 funding round. BCCC will have placed $19 million of its total $100 million allocation in non-metro counties.

How does the New Markets Tax Credit Program work?

The New Markets Tax Credit Program stimulates economic and community development and job creation in the nation’s low-income communities by attracting investment capital from the private sector.

The NMTC Program provides tax credits to investors who make “qualified equity investments” (QEIs) in investment vehicles called CDEs. CDEs are required to invest the proceeds of the qualified equity investments in low-income communities. Low-income communities are generally defined as those census tracts with poverty rates of greater than 20 percent and/or median family incomes that are less than or equal to 80 percent of the area median family income.

The credit provided to the investor totals 39 percent of the investment in a CDE and is claimed over a seven-year credit allowance period. In each of the first three years, the investor receives a credit equal to five percent of the total amount paid for the stock or capital interest at the time of purchase. For the final four years, the value of the credit is six percent annually. Investors may not redeem their investments in the CDEs prior to the conclusion of the seven-year period.

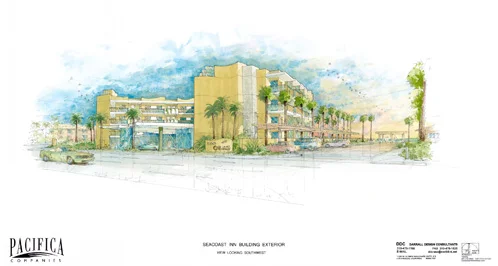

Sample Closed Transactions

BCCC Advisory Board Members

Contacts

Jerry Hannon

Border Communities Capital Company, LLC

Email: jhannon@chelseainvestco.com

James Schmid

Border Communities Capital Company, LLC

Email: jschmid@chelseainvestco.com